LTC Price Prediction: Technical and Fundamental Outlook for 2025

#LTC

- LTC trading below 20-day MA but showing MACD bullish signals

- Positive market sentiment driven by inflation data and institutional ETF filings

- Cloud mining growth and adoption supporting broader cryptocurrency ecosystem

LTC Price Prediction

LTC Technical Analysis

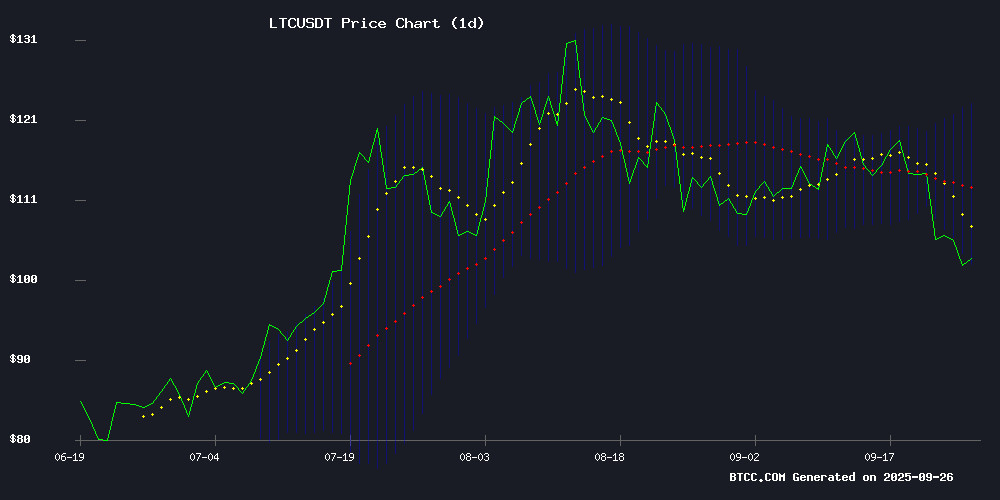

Litecoin is currently trading at $104.30, below its 20-day moving average of $112.76, suggesting short-term bearish pressure. However, the MACD indicator shows positive momentum with the MACD line at 2.8476 above the signal line at 0.1970, indicating potential upward movement. The Bollinger Bands position LTC NEAR the lower band at $102.75, which could act as support. According to BTCC financial analyst Robert, 'LTC's technical setup shows mixed signals but the MACD bullish crossover and proximity to Bollinger lower band suggest potential for rebound if support holds.'

Market Sentiment Analysis

Positive cryptocurrency sentiment is emerging as Bitcoin, Ethereum, and Litecoin gain following US inflation data. The cloud mining sector shows particular strength with FY Energy's transparent model attracting investors. BlackRock's Bitcoin Premium Income ETF filing indicates institutional confidence. BTCC financial analyst Robert notes, 'The combination of positive inflation data and growing cloud mining adoption creates favorable conditions for altcoins like LTC, though investors should monitor broader market trends.'

Factors Influencing LTC's Price

Bitcoin, Ethereum, and Litecoin Gain as Investors React to US Inflation Data

Bitcoin, Ethereum, and Litecoin posted modest gains as markets digested the latest US inflation figures, drawing renewed investor interest. These cryptocurrencies remain pillars of the digital asset space, each offering distinct technical advantages and use cases.

Bitcoin continues to anchor the crypto economy, its decentralized architecture and market dominance setting the tone for broader trends. Institutional adoption and global participation underscore its long-term growth potential.

Platforms like Hashj are lowering barriers to entry, offering tools to navigate the blockchain ecosystem efficiently. The service currently provides a $118 welcome bonus for new registrants, signaling growing infrastructure support for crypto participation.

FY Energy's Transparent Cloud Mining Model Attracts Investors with Guaranteed Returns

FY Energy is disrupting the crypto mining sector by offering fully transparent cloud mining contracts with fixed daily returns. The platform's open-book approach—displaying exact earnings before investment—resonates with risk-averse investors shifting from volatile trading in 2025.

Contracts range from a $20 LTC miner yielding 4% daily to premium $250,000 BTC setups generating $6,275 per day. This calculable ROI model, combined with clean energy infrastructure, positions FY Energy as a leader in sustainable crypto yield generation.

Notably, their ANTSPACE HW5 contract demonstrates institutional-grade potential—a $250,000 investment returns $163,150 over 26 days at 2.51% daily yield. Such predictable cash flow contrasts sharply with speculative trading, particularly for DOGE and BTC markets.

7 Most Profitable Cloud Mining Apps of 2025: FY Energy Leads Passive Crypto Income Race

Cloud mining emerges as the dominant force in passive crypto revenue generation for 2025, with FY Energy establishing itself as the frontrunner. The platform's $20 free trial offer and multi-currency support—including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Litecoin (LTC)—democratize access to mining profits without hardware investments.

Security remains paramount, with FY Energy leveraging McAfee® and Cloudflare® encryption alongside FinCEN compliance. The service distinguishes itself through renewable energy-powered data centers, addressing growing environmental concerns in proof-of-work operations.

Daily automatic payouts and beginner-friendly interfaces characterize the new wave of cloud mining platforms. This trend reflects broader market movements toward simplified crypto participation as institutional and retail interest converges.

Top 6 Best Altcoin Free Cloud Mining Providers in 2025 to Maximize Crypto Earnings

Bitcoin may dominate headlines, but altcoins like Ethereum (ETH), Dogecoin (DOGE), Solana (SOL), and Cardano (ADA) are capturing increasing attention from miners in 2025. The shift toward cloud mining platforms has rendered expensive GPU and ASIC rigs nearly obsolete, offering users a hardware-free path to altcoin rewards.

Leading the charge is ZA Miner, a platform combining AI-driven optimization with multi-coin support. Its $100 welcome bonus and contract-based model streamline entry for both novices and professionals. The system dynamically allocates mining power to high-yield assets—Ethereum, Dogecoin, and Litecoin among them—maximizing returns without manual intervention.

Transparency and reliability define this new wave of services. As traditional mining fades, cloud providers are reshaping the landscape with algorithmic efficiency and frictionless payouts.

BlackRock Files for Bitcoin Premium Income ETF to Generate Yield via Covered Calls

BlackRock has submitted an application to the SEC for a Bitcoin Premium Income ETF, designed to generate yield through covered-call options on Bitcoin holdings. The proposed fund would complement BlackRock's existing $87 billion iShares Bitcoin Trust (IBIT), which has seen $60.7 billion in inflows since January 2024.

The asset manager now oversees $101 billion in digital assets, with crypto ETFs contributing over $260 million in annual revenue. SEC approval of new generic listing standards could accelerate the review process for crypto ETFs from 240 days to 75 days, potentially fast-tracking ETFs for Solana, XRP, Litecoin, and Dogecoin.

Bloomberg ETF analyst Eric Balchunas notes the fund would sell covered calls on Bitcoin futures to create income streams, though this strategy caps upside potential compared to direct Bitcoin exposure. BlackRock's filing signals deepening institutional commitment to crypto yield strategies.

Top Cloud Mining Platforms of 2025 Offer Passive Crypto Earnings

The shift toward passive cryptocurrency income has accelerated in 2025, with cloud mining emerging as a preferred alternative to capital-intensive hardware setups. Leading platforms now enable browser-based extraction of Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Litecoin (LTC) without equipment or technical expertise.

FY Energy dominates the landscape with its risk-free $20 trial and automated payouts, leveraging renewable energy for BTC, ETH, DOGE, and LTC mining. The service exemplifies the sector's move toward accessible, sustainable solutions that bypass electricity costs and hardware maintenance.

Dogecoin Mining Gains Traction in 2025 as FY Energy Offers Risk-Free Cloud Mining

Dogecoin, once dismissed as a meme, has solidified its position in the cryptocurrency market with growing merchant adoption and a robust community. The surge in demand has transformed it into a viable investment, prompting innovative mining solutions.

FY Energy, a FinCEN-registered platform, now offers cloud mining contracts for Dogecoin alongside Bitcoin, Ethereum, and Litecoin. Its $20 free trial allows users to experience immediate returns without upfront hardware costs—a rare offering in an industry typically requiring significant capital.

The platform distinguishes itself through transparent profit visibility and instant withdrawals during trials. While competitors restrict promotional credits, FY Energy provides actual mining contracts from day one, lowering barriers to entry for retail participants.

Is LTC a good investment?

Based on current technical and fundamental analysis, LTC presents a mixed but potentially favorable investment case. The current price of $104.30 sits below the 20-day moving average, indicating short-term weakness, but technical indicators suggest potential for recovery.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $104.30 | Below 20-day MA |

| MACD | 2.8476 (Bullish) | Positive momentum |

| Bollinger Position | Near lower band | Potential support level |

Fundamentally, the positive reaction to US inflation data and growing institutional interest in cryptocurrency ETFs provide supportive market conditions. As BTCC financial analyst Robert suggests, 'LTC's current technical positioning near support levels combined with improving market sentiment could present a strategic entry point for patient investors.'